News archive for 2015

Overview of the news in 2015

78th WM Release

77th WM Release

New: International & Special Tax

76th WM Release

Small, new features in wmView, wmProfile and wmGuide

18.08.2015

78th WM Release

On October 19, 2015 the 78. WM Release will become effective. We would like to inform you about some upcoming alterations beforehand and corresponding impacts in WMACCESS.

New fields in the query profile Securities master data (G)

- GD205C NACE Rev.2

- GD734A Identifier indicating an appropriate diversification of indices according to EU-Regulation No. 575/2013

- GD968E Tax identifier of AT1 instruments with core equity features (CoCos)

New field in the query profile Issuer data (M)

- MD213C NACE Rev.2

New field in the query profile Capital measures (K)

- KD230 Cluster corporate actions matrix

New field in the query profile Conversion (U)

- UD230 Cluster corporate actions matrix

New field in the query profile Maturities & Drawings (V)

- VD130 Settlement of fractions in cash pursuant to recital 107

Frozen fields

No data fields, currently used in WMACCESS, will be frozen with this WM Release.

Further information from WM Datenservice:

Note:

Please note that all customer and special information from WM Datenservice are password protected since 16.04.2012. If you do not have your login data available or not known, please contact WM Datenservice via E-Mail.

28.04.2015

77th WM Release

On June 29, 2015 the 77. WM Release will become effective. We would like to inform you about some upcoming alterations beforehand and corresponding impacts in WMACCESS.

New fields in the query profile Securities master data (G)

- GV356 WpHG Sec. 9 reporting / date valid from/to

- GV359 WpHG Sec. 9 reporting for German OTCs / date valid from/to

New field in the query profile Income data (E)

- EV220 Dividend/currency option for income

New fields in the query profile Issuer data (M)

- MD212 BISTA issuer group

- MD226 Issuer group (Solvency Directive)

Frozen fields

On June 29, 2015 the static data field GD435 (Euroclear custody country) will be frozen. This field has been replaced in context of the 75th WM Release on October 20, 2014 by GD435A. We keep GD435 in the detail view of the query profile master data especially for older, inactive securities to be able to see their information content.

Further information from WM Datenservice:

Note:

Please note that all customer and special information from WM Datenservice are password protected since 16.04.2012. If you do not have your login data available or not known, please contact WM Datenservice via E-Mail.

17.04.2015

New: International & Special Tax

For many years tax-related financial data is a focus of WMACCESS.

Numerous in Germany relevant tax data in different WM products, such as for example in GAT, IFK or IFP

can already be queried in a pay-per-view manner.

With its new product WM now moves a step further and provides with Check-the-Box (USA), Stamp-Duty UK and

limited tax liability new information in a transnational context as well as information on the special regulations

on the AStG reporting.

On April 14th, 2015 we have integrated this new WM product named International and Special Tax (IST) into WMACCESS.

The following is an excerpt from the associated WM Customer Information:

Check-the-Box Taxation: Check-the Box is a taxation option in the US. This means that certain companies have, regardless of their actual legal form, the option to be taxed as a partnership or a corporation in the US.

Stamp Duty UK Taxation: Within the UK, British shares, subscription rights, warrants with Great Britain as country of origin and custody as well as certain foreign shares with Great Britain as country of custody (share register), are subject to the UK Stamp Duty taxation.

German Foreign Transaction Tax Act (AStG): The AStG has been adjusted by the German legislator. Capital investment companies are also affected by the changes. The Foreign Transaction Tax Act is supposed to ensure that taxation is made in Germany even though income or assets are transferred abroad. This means that capital investment companies may be subject to an inclusion amount pursuant to Section 10(1)1 of the Foreign Transaction Tax Act. WM provides a classification, if the company is subject to the regulation as well as the corresponding income data.

Limited Income Tax Liability: Income received from certain financial instruments is subject to tax, if the natural person subject to limited tax liability is neither resident nor domiciled in Germany. In Germany, income is subject to the investment income tax. WM identifies the affected financial instruments.

The following nine data fields are now available in the detail displays of query profile Securities master data and Income data:

New fields in the query profile Securities master data (G)

- GD968A Foreign Transaction Tax Act vehicle (AStG-Vehikel) pursuant to

section 19(4) of the Investment Tax Act - GD968B Check-the-Box-Procedure

- GD968C Limited taxable income pursuant to section 49 of the Income Tax Act

- GD968D Stamp-Duty UK

New fields in the query profile Income data (E)

- ED470A Inclusion amount (Hinzurechnungsbetrag) pursuant to section 10(1)1 of the Foreign Transaction Tax Act

- ED470B Taxable inflow of the inclusion amount (Hinzurechnungsbetrag) pursuant to section 10(2)1 of the Foreign Transaction Tax Act

- ED470C Offsettable foreign tax pursuant to section 10(1)1 of the Foreign Transaction Tax Act

- ED470D Distributions pursuant to section 3 no. 41a of the income tax act

- EV471 Inflow date of the inclusion amount pursuant to section 10(1)1 of the Foreign Transaction Tax Act against which the distributions in the sense of section 3 no. 41a of the income tax are offset

Further information from WM Datenservice with additional detail information regarding above data fields:

Note:

Please note that all customer and special information from WM Datenservice are password protected since 16.04.2012. If you do not have your login data available or not known, please contact WM Datenservice via E-Mail.

21.01.2015

76th WM Release

On February 23, 2015 the 76. WM Release will become effective. We would like to inform you about some upcoming alterations beforehand and corresponding impacts in WMACCESS.

New field in the query profile Securities master data (G)

- GD250A Insolvency status

New field in the query profile Income data (E)

- ED237B Zero identifier regarding ED237A

New fields in the query profile Conversion (U)

- UD130A Last order acceptance date for purchases of the disappearing fund ("cut-off-time")

- UD130B Last order acceptance date for sales at the disappearing fund ("cut-off-time")

- UD130C Date of distribution / reinvestment for the financial year of the disappearing fund

- UD130D Date of the last price calculation of the disappearing fund

- UD130E VAT-ID of the capital investment company regarding the reimbursement of expenses in connection with the durable medium

- UD130F Last trading date of the disappearing fund

- UD130G First trading date of the acquiring fund

Frozen fields

On February 23, 2015 the two static data fields GV746 and GV748 will be frozen. Both fields have been replaced a year ago by the following fields:

- GV956 Inflation linked interest portion (replaced GV746)

- GV958 Indexation coefficient (replaced GV748)

Further information from WM Datenservice:

Note:

Please note that all customer and special information from WM Datenservice are password protected since 16.04.2012. If you do not have your login data available or not known, please contact WM Datenservice via E-Mail.

19.01.2015

Small, new features in wmView, wmProfile and wmGuide

Three new features are now available in WMACCESS via Internet.

wmGuide: Full text search in field descriptions

Up to now wmGuide

offered a search function for the field identification (e.g. "GD100")

as well as for field name (e.g. "Status reason").

Now a case-insensitive full text search is added, which searches the complete field descriptions.

The following wildcard characters are supported:

* = Placeholder for any number of characters

? = Placeholder for exactly one character

Full text search with wildcard characters

wmView: Hide cancelled rows in linkage fields

Sometimes it is pretty annoying to identify the valid entries in certain linkage fields such as ID917 (Estimated undisclosed accumulated deemed distribution income) due to a large number of cancelled entries mixed with a small number of valid entries.

Now WMACCESS will offer a function in the column header to hide cancelled rows, if a mixed situation of valid and cancelled entries is present.

Hide cancelled entries by clicking on the column header

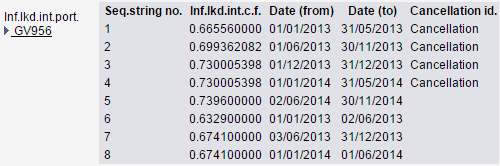

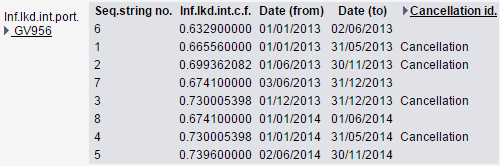

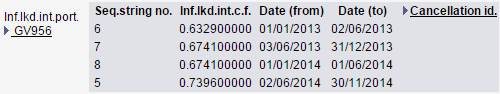

wmView: Sorting linkage fields

So far most of the linkage fields in WMACCESS such as GV451 (Historical classification funds) are completely supplied by WM Datenservice and therefore those fields appear in a proper business oriented order in wmView and wmProfile. Some of the younger linkage fields, however the supplied sequence (Seq. String No) should no longer necessarily correspond to a business oriented logical order, usually a valid from data field. For such fields, the display was sub-optimal in WMACCESS under certain circumstances. Therefore, we have now entered a different sort order for many linkage fields, so that the entries now usually are sorted based on the respective date field.

Previous display:

New display with improved sorting:

New display with improved sorting & cancelled rows hidden:

Test our products with real data. This test access is nonbinding, risk-free and without charge.

Sign up for productive use.

WMACCESS and www.wmaccess.com

Copyright © 2026 CPB Software (Germany) GmbH.