News archive for 2017

Overview of the news in 2017

New query profiles for MiFID II / MiFIR and PRIIPs

Extensive increase of our data spectrum for regulatory data

Query profile renamed

Easier and faster to the desired search mask

84th WM Release

83rd WM Release

Disabling unencrypted HTTP communication

Display issuer name for the issuer number in MR030 & HD051

82nd WM Release

14.12.2017

New query profiles for MiFID II / MiFIR and PRIIPs

As of January 2018, the requirements of the EU Directive on the markets for financial instruments (MiFID II) and the affiliated regulation (MiFIR) must be implemented by the market participants in production.

In the following, as announced in our news release from 05.12.2017, we would like to describe the query profiles for MiFID II / MiFIR and PRIIPs with the associated query costs:

- MiFID II - Reference data » query costs

- MiFID II - Target market » query costs

- MiFID II - Cost transparency » query costs

- Ongoing indicators (J) » query costs

- PRIIPs Reference data » query costs

In addition, the existing query profiles Stock exchanges & trading practices (X) and Issuer data (M) will be extended.

These query profiles will be available soon via WMACCESS Internet.

Update 18.12.2017: The new query profiles are now available.

MiFID II - Reference data

The query profile MiFID II - Reference data contains all relevant data for MiFID II and MiFIR. For example, the extension of the existing transparency regulations, the investor protection and the adjustment of the market infrastructure.

The data for target market classification and

cost transparency are assigned to their own query profiles.

Show / hide complete list of included WM fields.

Query costs:

For this query profile the query fee category T6 applies.

On this page you will find an overview of the query profiles with the information in which query fee category a hit list or detail view falls.

MiFID II - Target market

The rules in MiFID II require the manufacturer / issuer of financial instruments to define a target market for each instrument. This must be considered by the selling agency.

The query profile MiFID II - Target market covers all manufacturer data, as well as the information on the target market (Product Governance).

Show / hide complete list of included WM fields.

Query costs:

For this query profile the query fee category T6 applies.

MiFID II - Cost transparency

In addition to the definition of the target market, the detailed disclosure of costs (ex ante and ex post) is one of the main innovations and challenges from the new requirements of the Financial Markets Directive and Regulation

(MiFID II / MiFIR).

As a service provider of securities-related information, WM Datenservice will represent the costs arising from the instrument; which are independent of the respective financial service provider.

The Cost transparency data is divided into two categories / query profiles:

- Data with master data character (only current value, low change frequency) in the query profile MiFID II - Cost transparency

- Date-related data with complete history in the query profile Ongoing indicators (J)

Show / hide complete list of included WM fields.

Query costs:

For this query profile the query fee category T3 applies.

Ongoing indicators (J)

In the query profile Ongoing indicators (J), date-related data with complete history for cost transparency is displayed.

For licensing reasons, a query search allows a period of up to 31 days. To query a larger time frame, multiple search queries must be made.

Show / hide complete list of included WM fields.

Query costs:

For this query profile the query fee category T3 applies.

PRIIPs Reference data

With the come into effect of the PRIIPs Regulation at the beginning of January a greater transparency for the investor in purchasing Packaged Retail and Insurance-based Investment Products (PRIIPs) should be created. From this point, the corresponding Key Information Documents (KIDs) for each PRIIPs-relevant financial instrument must be prepared by the manufacturer and handed over to the customer in advance by the sales office.

The identification of PRIIPs relevant financial instruments with it´s relevant information such as, for e.g. the SRI (risk indicator), the available KID versions, the complexity indicator (or warning) and other master data are displayed under this profile.

Show / hide complete list of included WM fields.

Query costs:

For this query profile the query fee category T3 applies.

New fields in the existing query profile Stock exchanges & trading practices (X):

- XD022 ? Regulated market/MTF (as per MiFID) identifier

- XD026 Market segment/place MIC

- XD027 Market place time shift vs. UTC

- XD209 Market ID pursuant to MiFID II

- XD209A SME growth market ID

New field in the existing query profile Issuer data (M):

- MD503 Bank identifier code (BIC)

05.12.2017

Extensive increase of our data spectrum for regulatory data

We are very pleased to announce that at the beginning of 2018 the data spectrum of WMACCESS Internet regulatory data will increase significantly. In cooperation with WM Datenservice, we will be able to provide data on the MiFID II / MiFIR and PRIIPs regulations.

In this context, we would like to thank all participants of our survey from spring 2017 for the insightful feedback on these topics.

Scope of MiFID II / MiFIR data offer

MiFID II / MiFIR contains the following topics:

- Target market classifications

- Cost transparency

- Classification of financial instruments

- Identification of leverage products

- Tick size as per MiFID II

- Product Approval Procedure Identifier

- Complexity identifier

- Classification of pre-/ post-trade relevance

- Article 26 transaction reporting as per MiFIR

- Transaction reporting direct/ indirect identifier

- Standard market size identification

- Market liquidity and financial instruments classification

- Markets classification

- Instrument with an embedded derivative identifier

- FIRDS (Financial Instruments Reference Data System) identifier / ESMA identifier

Scope of PRIIPs data offer

The PRIIPs data include the following WM fields:

- GD496A PRIIPs identifier

- GD496B Source identifier

- GD496C Current KID (EU) PRIIPs regulation available, manufacturer

- GD496D Current KID (EU) PRIIPs regulation available, EDH

- GD496E Type of KID provision

- GD496F Investor documents for funds available, manufacturer

- GD496G Investor documents for funds available, EDH

- GD496H Risk indicator

- GD496I KID PRIIP warning notes in current KID (complex product)

- GV491 KID PRIIP versions

Query profiles and query costs

The WM fields for MiFID II / MiFIR and PRIIPs will be mostly available in new query profiles, a few will be integrated into our existing query profiles for Issuer data or Stock exchanges & trading practices. The final design of the new query profiles as well as the query fee category will take a few more days. We will amend this information as soon as possible here or in an extra news.

27.11.2017

Query profile renamed

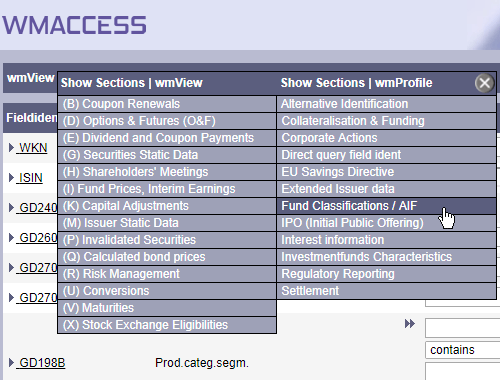

Today, the announced merge of the wmView and wmProfile query profiles has been done.

At the same time, the query profile "Risk management II / AIF" was renamed into "Fund Classifications / AIF".

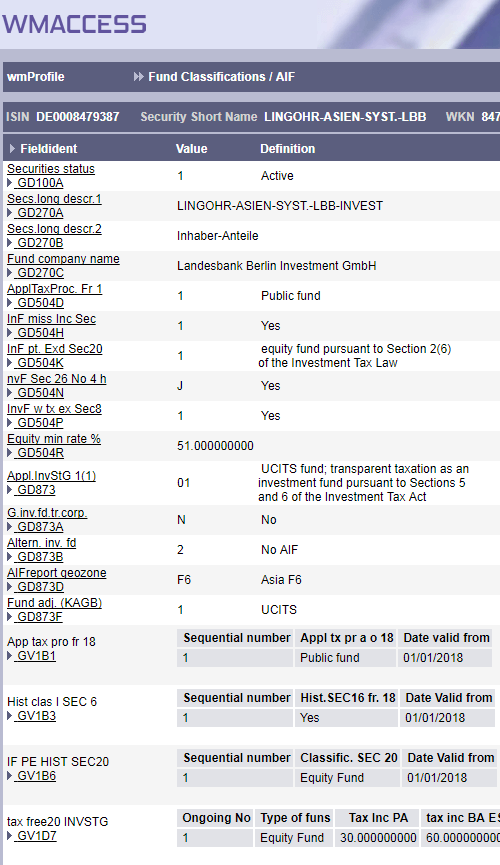

Extract from the detail view of the query profile Fund Classifications / AIF

06.09.2017

Easier and faster to the desired search mask

Soon the query profiles from wmView and wmProfile will be merged in the profile selection box. From now on, you can access the various search masks more easily and conveniently.

Enhanced wmView & wmProfile query profile selection

Did you already know...?

For licensing reasons, some GD/GV fields are not included in the detail display for the work area (G) master data in wmView.

Instead, such WM data fields are often integrated exclusively in the wmProfile query profile of Investment Fund Characteristics

or Fund Classifications / AIF (previously Risk management II / AIF).

The Fund Classifications / AIF query profile contains data for the classification of investment funds according to AIFMD and for the reform of investment taxation 2018. For example, the WM fields:

- GD504D Applicable tax procedure as of 1 January 2018

- GD504K Investment funds with partial tax exemption as per section 20 of the investment tax law

- GV1D7 Rate of the tax free income as per fund type and investor group as per section 20 of the investment tax law, historical classification

Use this page to find out which query profile contains a particular WM field.

10.08.2017

84th WM Release

On October 23, 2017 the 84. WM Release will become effective. We would like to inform you about some upcoming alterations beforehand and corresponding impacts in WMACCESS.

New field in the query profile Income data (E)

- ED156 Domestic income with investment income tax deduction by the custodian of the investment fund

New fields in the query profile Securities master data (G)

- GD260B Issuer's security short description

- GD189L Contract type 871(m)

- GD432B FSMA registered fund

- GD432C Belgian stock exchange tax (TOB) in percent

- GD505G Identification of instruments not subject to marginal number 59 of the BMF letter individual questions on the final withholding tax

New fields in query profile Risk management II / AIF

Note: The name of this query profile is expected to be renamed by us into Fund Classifications / AIFMD (AIF).

- GD504R Equity participation rate in percent

- GD504S Real estate minimum rate in percent

- GD505H Identification of instruments which result in income subject to corporation tax in the case of investment funds as per section 6 (3)-(5) of the investment tax act

- GD505J Capital claims with issuing yield

- GV1D7 Rate of the tax free income as per fund type and investor group as per section 20 of the investment tax law, historical classification

- GV1D8 Issue yield as per section 38(3) of the investment tax law

- GV1D9 Investment fund status confirmation with reference number and tax number as per section 7 (3) of the investment tax law

New fields in the query profile Investment Funds Prices (I)

- ID930 Profits subject to a double taxation agreement as per section 48 (5) of the investment tax law for special funds

- ID931 Fund capital gains from shares as per section 48(3) of the investment tax law for special investment funds

- ID932 Profits subject to a partial tax exemption in respect of business assets (income tax act) as per section 48 (6) of the investment tax law for special investment funds

- ID933 Profits subject to a partial tax exemption in respect of business assets (corporate tax act) as per section 48 (6) of the investment tax law for special investment funds

- ID934 Profits subject to a partial tax exemption in respect of private assets including life and health insurances as per section 48(6) of the investment tax law for special investment funds

- ID935 Equity participation rate in percent

- ID936 Share in the total fund assets in percent

- ID937 Real estate rate in percent

New fields in the query profile Capital measures (K)

- KD028A Over subscription identifier

- KD032A Payable date record date

New fields in the query profile Conversion (U)

- UD027A Payable date record date

- UD193B Durable medium effective date

- UV242 Compensation/payment amount

Depending on further regulatory developments another data field on the topic of US IRC Section 871(m)

could be added by WM Datenservice to the 84th WM Release as part of the new Section J - Ongoing indicators.

For this purpose, we will set up a separate query profile in WMACCESS.

Due to the proximity to securities master data, a query in this new query profile is classified into the query fee category

T3.

New query profile Ongoing indicators (J)

- JV006 Delta/set by using an end of day delta

Update 01.09.2017:

According to our current information, the American regulation agency has in its Notice 2017-42 of 4 August 2017 extended the transitional provisions for the IRC Section 871(m) to the end of 2018. This means that the new field JV006 will, for that reason, not be supplied until further notice.

Therefore, we will wait out for the setup of the query profile until further notice.

Frozen fields

No data fields, currently used in WMACCESS, will be frozen with this WM Release.

Further information from WM Datenservice:

Note:

Please note that all customer and special information from WM Datenservice are password protected since 16.04.2012. If you do not have your login data available or not known, please contact WM Datenservice via E-Mail.

13.04.2017

83rd WM Release

On June 26, 2017 the 83. WM Release will become effective. We would like to inform you about some upcoming alterations beforehand and corresponding impacts in WMACCESS.

New field in the query profile Income data (E)

- EV489 Dividend equivalent as per IRC Sec 871(m)

New fields in the query profile Securities master data (G)

- GD189E Basket type

Update as of 01.06.2017 - 5 additional fields: - GD209D Product intervention identifier

- GV1A7 Product intervention / date valid from/to

- GD209J Article 26 transaction reporting pursuant to MiFIR

- GD209L Transaction reporting direct/indirect identifier

- GV2A0 Article 26 transaction reporting as per MiFIR / date valid from/to

New field in the query profile Capital measures (K)

- KD131 Legal Entity Identifier (LEI) of the subscription agent

New fields in the query profile Conversion (U)

- UD116A Clearstream-Account-No. (Customer account number)

- UD131 Legal Entity Identifier (LEI) of the exchange agen

Frozen fields

No data fields, currently used in WMACCESS, will be frozen with this WM Release.

Further information from WM Datenservice:

Note:

Please note that all customer and special information from WM Datenservice are password protected since 16.04.2012. If you do not have your login data available or not known, please contact WM Datenservice via E-Mail.

17.03.2017

Disabling unencrypted HTTP communication

For many years we are supporting the encrypted access to the WMACCESS website via HTTPS as well as the safe login procedure parallel to the unencrypted HTTP communication.

The unencrypted transmission of sensitive information, such as the WMACCESS username and the associated password, will be deactivated as of 18.06.2017. HTTP will be automatically redirected to the encrypted connection.

In the first place this concerns the URLs for logging on and using the WMACCESS application to query WM data. On the login page of WMACCESS we will remove the unencrypted login option ("standard login procedure").

Test:

Successful: You are viewing this page through an HTTPS connection. Your browser is not affected by the announced action.

Problems using HTTPS?

Should you not be able to access the homepage and the WMACCESS web application due to technical restrictions with HTTPS, please do not hesitate to contact us.

Why do we perform this step only in the year 2017:

Unfortunately, very old browsers (such as Internet Explorer 6) or older operating systems (eg Windows XP) were used in the financial industry in the past few years. However, these browsers or operating systems only support older and unsafe protocols (SSLv2 / SSLv3) or do not provide support for modern secure cipher suites. Users of these platforms had to and so far could use the HTTP protocol.

Preview:

Starting from the 7th of August 2017, the entire Internet presence under our domain wmaccess.com will automatically and exclusively use HTTPS.

20.02.2017

Display issuer name for the issuer number in MR030 & HD051

In March 2012, we had already made an improvement to the wmView detail display, in order to display the current issuer name (MD031) directly to the three WM fields GD240, GD241, GD245.

This has been implemented for two additional fields:

- MR030 Superordinate issuer number

- HD051 Issuer number of the controlling company

Display of the issuer name to the right of the issuer number 709535 in field HD051

04.01.2017

82nd WM Release

On February 20, 2017 the 82. WM Release will become effective. We would like to inform you about some upcoming alterations beforehand and corresponding impacts in WMACCESS.

The new WM fields in regards to the investment taxation 2018 will be created for the February 2017 Release, but will not come into effect before the 83rd Release on 26.06.2017

Update 17.01.2017:

Please note that many of the new GD fields are not displayed in the Securities master data query profile because of licensing restrictions.

Rather, these data fields are to be found exclusively in the wmView query profile Risk Management II / AIF.

Two further fields exclusively in the wmProfile query profile Investment Fund Characteristics

Field descriptions as of 10.01.2017 are already available in wmGuide. Please note, that the English-language field descriptions are currently missing for most new data fields.

New fields in the query profile Income data (E)

- ED476 Distribution as per section 2(11) of the investment tax law in the case of investment funds

- ED476A Taxable preliminary lump sum in euro as per section 18 of the investment tax law

- ED476B Zero identifier in ED476A tax-able preliminary lump sum in euro as per section 18 of the investment tax law

- ED476D Taxable preliminary lump sum in fund currency as per section 18 of the investment tax law

- ED476E Zero identifier in ED476D tax-able preliminary lump sum in fund currency as per section 18 of the investment tax law

- ED476F Basis rate as per section 18 (4) of the investment tax law

- ED476G Ongoing distribution in the case of investment funds in liquidation as per section 17 of the investment tax law

- ED476H Tax free asset distribution in the case of investment funds in liquidation as per section 17 of the investment tax law

- ED476J Taxable distribution with partial exemption as per section 20 of the investment tax law (equity funds 30% private assets)

- ED476K Taxable preliminary lump sum as per section 18 of investment tax law in euro with partial exemption as per section 20 of the investment tax law (equity funds 30% private assets)

- ED476L Taxable distribution with partial exemption as per section 20 of the investment tax law (mixed funds 15% private assets)

- ED476M Taxable preliminary lump sum as per section 18 of investment tax law in euro with partial exemption as per section 20 of the investment tax law (mixed funds 15% private assets)

- ED476N Taxable distribution with partial exemption as per section 20 of the investment tax law (property funds 60%, private assets, business assets (income tax act), business assets (corporate tax law)

- ED476P Taxable preliminary lump sum as per section 18 of the investment tax law in euro with partial exemption as per section 20 the investment tax law (property funds 60%, private assets, business assets (income tax act), business assets (corporate tax act)

- ED476Q Taxable distribution with partial exemption as per section 20 of the investment tax law (property funds 80%, private assets, business assets (income tax act), business assets (corporate tax act)

- ED476R Taxable preliminary lump sum as per sect. 18 of the investment tax law in euro with partial exemption as per sect. 20 of the investment tax law (property funds 80%, private assets, business assets (income tax act), business assets (corporate tax act)

- ED476S Offsettable foreign withholding tax on the fund distribution side in consideration of the partial exemption of fund units held as private assets as per section 20 of the investment tax law

- EV477 Taxable preliminary lump sum in euro as per section 18 of the investment tax law, per month

- EV478 Taxable preliminary lump sum in fund currency as per section 18 of the investment tax law, per monthtax.

- EV479 Taxable distribution with partial exemption as per section 20 of the investment tax law (equity funds 60/80% business assets)

- EV480 Taxable preliminary lump sum in euro as per section 18 investment tax law with partial exemption as per section 20 of the investment tax law (equity funds 30% private assets) per month

- EV481 Taxable preliminary lump sum in euro as per section 18 of the investment tax law with partial exemption as per section 20 of the investment tax law (equity funds 60%/80% business assets)

- EV482 Taxable preliminary lump sum in euro as per section 18 of the investment tax law with partial exemption as per section 20 of the investment tax law (equity funds 60%/80% business assets), per month

- EV483 Taxable distribution with partial exemption as per section 20 of the investment tax law (mixed funds 30/40% business assets)

- EV484 Taxable preliminary lump sum in euro as per section 18 investment tax law with partial exemption as per section 20 of the investment tax law (mixed funds 15% private assets) per month

- EV485 Taxable preliminary lump sum in euro as per section 18 of the investment tax law with partial exemption as per section 20 of the investment tax law (mixed funds 30/40% business assets)

- EV486 Taxable preliminary lump sum in euro as per section 18 of the investment tax law with partial exemption as per section 20 of the investment tax law (mixed funds 30/40% business assets), per month

- EV487 Tax. preliminary lump sum in euro as per sect. 18 of the investment tax law with part. exemption as per sect. 20 of the investment tax law (property funds 60% private assets, business assets investment tax law, business assets corporate tax law) per month

- EV488 Tax. prelim. lump sum in euro as per sect. 18 of the investment tax law with part. exemption as per sect. 20 of the investment tax law (property funds 80% private assets, business assets investment tax law, business assets corporate tax law) per month

New fields in the query profile Securities master data (G)

- GD221G Classification of bail-in instruments

- GD221H BRRD issuer

- GD221J Legal responsibility bail-in

- GD504C Application of the investment tax law (InvStG) as of 1 January 2018

- GD504E Equity holding pursuant to section 2(8) no. 1, 2 of the investment tax law

- GV1B0 Application of the investment tax law (InvStG), historical classification as of 1 January 2018

- GV1B5 Basis rate as per section 18 (4) of the investment tax law

- GV1B8 German participation income as per section 6 (3) of the investment tax law /german property income as per section 6 (4) of the of the investment tax law /other german income as per section 6 (5) of the investment tax law

New fields in query profile Risk management II /AIF

Fund Classifications / AIF

- GD504D Applicable tax procedure as of 1 January 2018

- GD504F Transparency exercise option as per sections 30,31 of the investment tax law

- GD504G Investment funds and/or unit classes as per section 10 of the investment tax law for tax privileged investors

- GD504H Investment funds with missing income as per section 6 of the investment tax law:

- GD504J Investment funds subject to business tax as per section 15 of the investment tax law

- GD504K Investment funds with partial tax exemption as per section 20 of the investment tax law

- GD504L Investment funds with partial tax exemption as per section 20 of the investment tax law

- GD504M Investment funds as per section 2 (15) of the investment tax law

- GD504N Investment funds as per section 26 (4) letter h of the investment tax law

- GD504P Investment funds without tax exemption due to tax privileged investors as per section 8 of the investment tax law

- GD504Q Corporate bodies as per section 42 ( 3) sentence 1 of the investment tax law

- GV1B1 Applicable tax procedure, historical classification as of 1 January 2018

- GV1B2 Investment fund status confirmation as per section 7 (3) of the investment tax law

- GV1B3 Investment funds with missing income as per section 6 of the investment tax law, historical classification

- GV1B4 Investment funds in liquidation as per section 17 of the investment tax law

- GV1B6 Investment funds with partial tax exemption as per section 20 of the investment tax law, historical classification

- GV1B7 Investment funds with partial exemption as per section 20 (4) of the investment tax law, historical classification

New fields in query profile Investment Fund Characteristics

- GD535A Index replication regarding index funds

- GV119 Index funds - index

New fields in the query profile Investment Funds Prices (I)

- ID927 Accumulated tax free asset distributions (section 17(3) of the investment tax law)

- ID928 Prelimanry lump sum in the case of units in euro per month

- ID929 Accumulated prelimanry lump-sum in the case of units

New field in the query profile Issuer data (M)

- MD664 BRRD-issuer

- MD664A Legal responsibility bail-in

New field in the query profile Maturities & Drawings (V)

- VD099 Pool factor after redemption

New field in the query profile Stock exchanges & trading practices (X)

- XD482 Inclusion/admission identifier

Frozen fields

No data fields, currently used in WMACCESS, will be frozen with this WM Release.

Further information from WM Datenservice:

Note:

Please note that all customer and special information from WM Datenservice are password protected since 16.04.2012. If you do not have your login data available or not known, please contact WM Datenservice via E-Mail.

Test our products with real data. This test access is nonbinding, risk-free and without charge.

Sign up for productive use.

WMACCESS and www.wmaccess.com

Copyright © 2026 CPB Software (Germany) GmbH.