Interim Profits

Interim Profit of Investment Funds

Interim profits are the gains contained in the sales or return price for interests received or accrued, which have not been distributed or retained by the fund yet and are thus not yet liable for taxation by the investor.

Scope and History of Interim Profits

Our WMACCESS database comprises current and historical interim profits on more than 82,000 investment funds from 32 countries, including:

- 53,800 from Luxemburg

- 11,300 from Ireland

- 5,100 from Germany

- 3,400 from Austria

- 1,900 from France

- 1,840 from Switzerland

- 1,400 from Great Britain

- 1,250 from Liechtenstein

The data history of the interim profits reaches back to 1994 and by now comprises more than 89 million individual interim profits in 40 currencies.

Query of Current and Historical Interim Profits

All interim profits published by Wertpapier Mitteilungen (WM) are available at WMACCESS for query. For one single application of WMACCESS or infrequent queries we offer the affordable price model WMACCESS On-Demand, and also for regular or intensive query requirements we provide the appropriate price model.

Who uses WMACCESS for the query of tax relevant data like interim profits?

- banks

- fund companies

- tax consultants

- auditors

- specialised lawyers for fiscal law

- lawyers

- financial service providers

- private persons

What do WMACCESS clients use the queried interim profits for?

The applications of the queried interim profits are manifold:

- verification of tax certificates and revenue records

- verification / completion of foreign bank documents / tax reports

- voluntary declaration in order to avoid punishment

- determination of the assessment basis for the capital yield tax deduction in the event of return or alienation of investment certificates

- tax declaration, annex KAP (income from capital) of the tax return form

- calculation of tax parameters at umbrella fund level

(interim profit of target fund)

Where can interim profits be queried?

In this tutorial we will explain the query of interim profits step by step.

How are the queried interim profits presented?

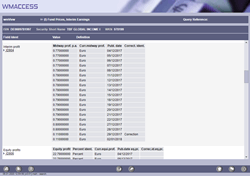

Click on the adjacent illustration. This screenshot shows how interim profits are presented in WMACCESS, ordered by currency and date of publication.

Can the query of interim profits be tested for free?

Yes, of course they can. Please apply for free test access.

Convinced?

Please download the contract and carry out a free express installation by email.

Correction of Interim Profits

As a rule, each interim profit is calculated and published every trading day. Many fund companies, however, correct their data afterwards, sometimes after months or even years. These notifications must be recognised and considered for the calculation of the taxable base.

We offer comfortable monitoring for corrections of interim profits. You will be informed automatically about alterations of all securities supervised or administered by you.

Contact us for more details.

Further Tax Relevant Data for Funds

Besides interim profits, also other tax relevant data for funds are comprised in the extensive WMACCESS data spectrum. These include:

- real estate profits

- equity profits

- accumulated deemed distribution income

- accumulated distributed past capital gains

- accumulated substance distributions

- rectified accumulated deemed distribution income

- Fund revenues (distributions and reinvestments)

- securities master data for fiscal classification

Test our products with real data. This test access is nonbinding, risk-free and without charge.

Sign up for productive use.

WMACCESS and www.wmaccess.com

Copyright © 2024 CPB Software (Germany) GmbH.